EXTRA SPACE (ASIA)

The Extra Space investment portfolio was established in 2006 by USSFM founders Robert Gregg and Jonathan Perrins to take advantage of the self storage investment opportunities in key Asian markets.

INVESTMENT OVERVIEW

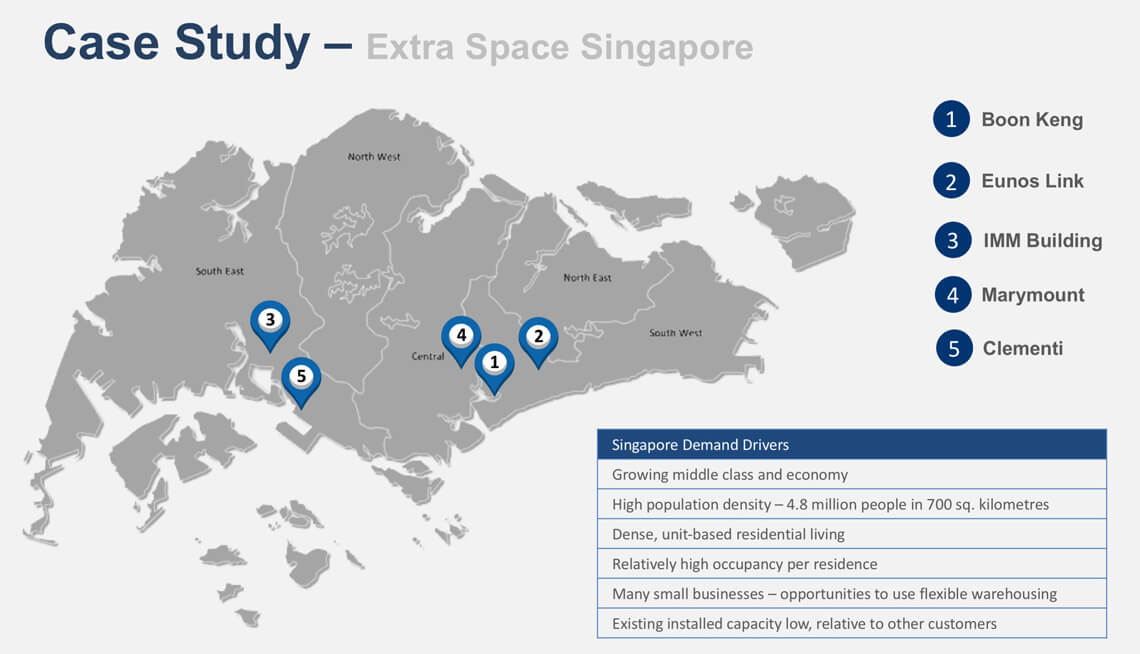

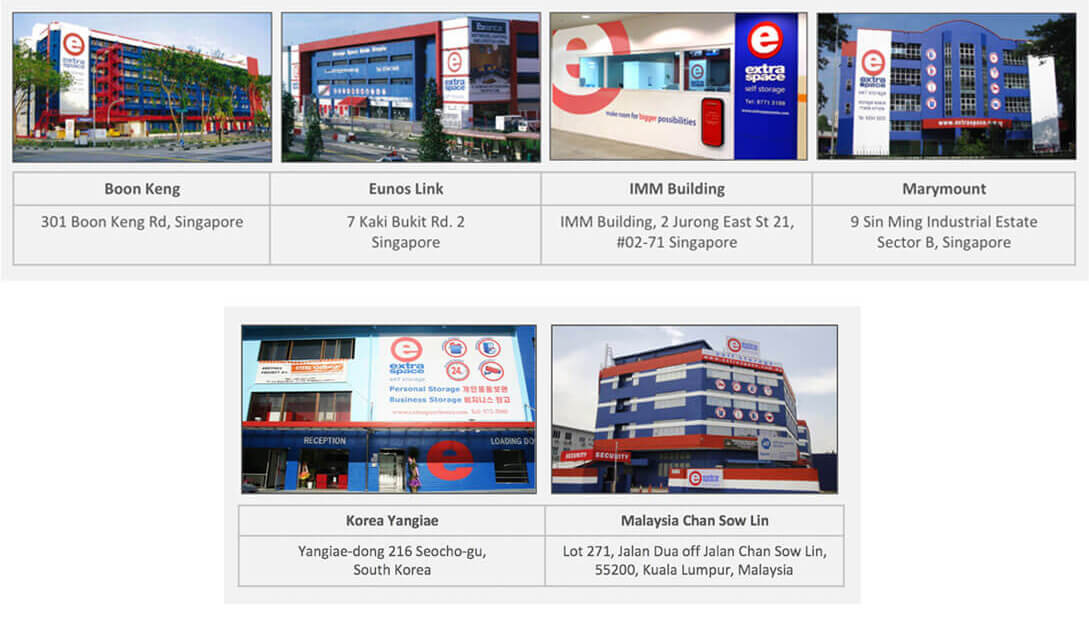

The Extra Space portfolio consisted of 4 self storage facilities in Singapore, 1 in Malaysia and 1 in South Korea, with a combined net lettable area of over 450,000 sq ft.

PROJECT VALUE

To fund the developments, investors contributed $24 million (AUD) and were returned $48 million (AUD) over a 5 year period. Debt was sourced in the local currency at a LVR of 55%.

Market Opportunity

- Identify Asian markets where key demand drivers are emerging or present and supply favourable opportunities

- To provide residential and commercial self storage space at 3 times the current industrial property yield

- Opportunity to develop a brand that is meaningful, defensible and scalable to the whole Asian community where the property opportunity exists

- Early mover opportunity in dynamic Asian economies

- Taking advantage of low industrial property prices

Strategy

- Leverage the product market knowledge and product expertise of Steel Storage

- Develop a brand that is Asian in its style but Western in its origin

- Find end of life industrial buildings and give them higher and better use

- Create a financial model that will give investors a high return and customers a great experience

- Rapidly develop critical market share and coverage

Portfolio

Outcomes

- First site acquired February 2007 and opened June 2007

- Funded by Australian equity – from an opportunistic Private Equity fund and Steel Storage

- Local partner in Singapore; sole investor in Korea and Malaysia

- 6 facilities developed in 3 major Asian markets

- Investment exited in 2014 by a private sale resulting in a 20% IRR, post currency, over a 5 yr. investment period