Australia Prime Storage Fund (Australia)

The Australian Prime Storage Fund (APSF) was established in 2015 to develop and own state of the art self storage centres located in the major capital cities on the east coast of Australia. APSF was a joint venture investment between Universal Self Storage Prime Storage Fund (USSPSF) (75.1% ownership) and National Storage (NSR) (24.9% ownership).

FUND OVERVIEW

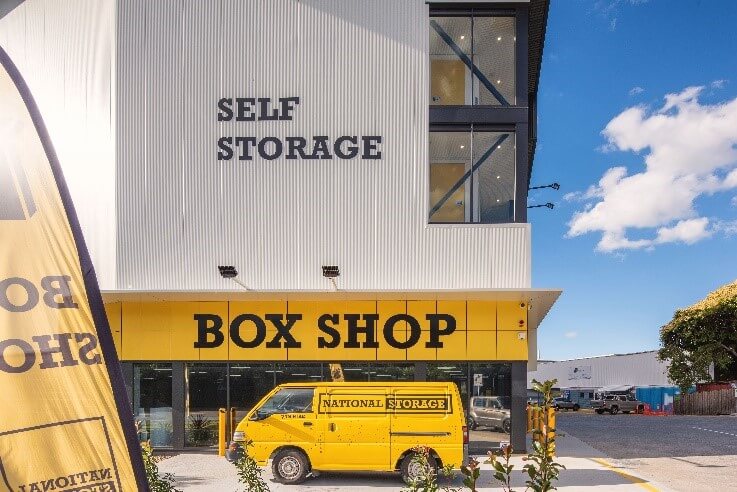

Established to develop new, marketing leading self storage centres within 10 kms of the major cities of east coast Australia and New Zealand. At its peak the APSF portfolio consisted of 4 self storage facilities in Kelvin Grove (QLD), Albion (QLD), Carrara (QLD) and Canterbury (Victoria), with a combined net lettable area of 23,400 sqm (the APSF Portfolio).

PROJECT VALUE

The Total Development Cost of the APSF Portfolio reached approximately $60m . Debt was sourced at an LVR of approximately 50% of the Project Value and equity was raised by USSFM from NSR and USSPSF.

Market Opportunity

- Undersupply of new prime quality self storage centres in the high consumer density areas of major cities in Australia and New Zealand.

- Opportunity to partner alongside industry leading operator in the development of a new portfolio of modern self storage centres.

- Targeted the attractive rental rates in the major city centres on the east coast of Australia.

Strategy

- Leverage the development experience of USSFM with the operating expertise of National Storage.

- Strong alignment of interests with co-ownership of each of the APSF centres.

- Maximise investor returns throughout the entire project lifecycle from development through to stabilised occupancy.

Portfolio

Carrara (QLD)

- Approximately 5,700 sqm of net lettable area

- 3 levels; light steel construction

- Large, high quality reception and retail area

- Automated site access, security and individual unit alarms

- Dehumidified storage unit offering

- Solar powered

Albion (QLD)

- Approximately 6,340 sqm of net lettable space over 4 levels

- Large, high quality reception and retail area

- Automated site access, security and individual unit alarms

- Dehumidified storage unit offering

- Solar powered

Kelvin Grove(QLD)

- Approximately 5,500 sqm of net lettable space

- 5 levels; light steel construction

- Large, high quality reception and retail area

- Automated site access, security and individual unit alarms

- Dehumidified storage unit offering

- Solar powered

Canterbury (VIC)

- Approximately 5,900 sqm of nla over 5 levels.

- Large, high quality reception and retail area

- Automated site access, security and individual unit alarms

- Solar powered

Outcomes

- USSFM identified, designed and developed 4 centres with over 23,000 sqm of industry leading self storage space on behalf of APSF.

- USSPSF successfully exited its 75.1% ownership in APSF via a negotiated sale to National Storage in late 2019.

- Investment returns, as measured by levered IRR, of greater than 15% at the project level.

- A total return to investors of 1.43x times monies invested.

- A pre-tax total internal rate of return (IRR) of approximately 11% (post fees) over a 4-year investment timeframe.